Personalized metal...

Analysis of the development trend of the metal box container industry in 2021

1. The metal box packaging industry has a wide variety of products, and the future development potential of the food cans and chemical cans markets is huge

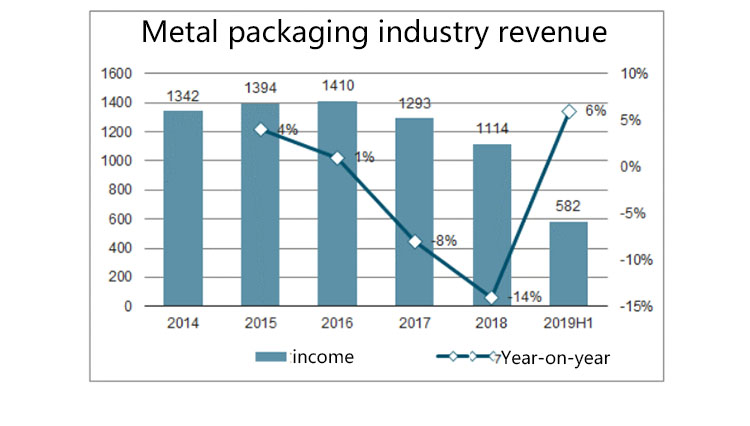

The metal packaging industry has a broad market and a rich variety of products. Metal packaging refers to thin-walled packaging containers made of thin metal plates. The main products are: tin boxes, tin cans, beverage cans (steel, aluminum two-piece cans, tin-plated iron three-piece cans), food cans and chemical cans, etc. The operating income of the metal box packaging industry in 2020 will be 111.4 billion U.S. dollars. It is expected that the metal box packaging industry's income will increase steadily in 2021, with operating income of 150 billion U.S. dollars, an increase of 2.54%. With the continuous elimination of backward production capacity in the metal packaging industry, industry revenue has declined in 2017 and 2018, and industry revenue has resumed positive growth from 2019. The relatively high category in the metal packaging industry is beverage tins (33%), followed by metal lids, metal large cans, food tins and chemical tins, accounting for 15%, 13%, 12% and 11% respectively .

Metal packaging industry revenue and year-on-year data

Data from the "2020-2026 International Metal Packaging Industry Market Trends and Strategic Consulting Research Report" released by Zhiyan Consulting Agency shows that economic growth and consumption upgrades drive the development of the metal packaging industry. The international metal packaging industry has grown from USD 41.21 trillion in 2016 to USD 99.09 trillion in 2019, an increase of 9.17%, and from USD 30,800 in 2010 to USD 70,900 in 2019, an increase of 8.69%. The rapid global economic growth has driven the metal packaging industry into a rapid development track. From the perspective of global packaging production and demand, the consumption of packaging products is positively correlated with the level of economic development.

Changes in the total value of the US metal packaging industry

1). The scale of the chemical tank market has steadily increased, supporting the steady growth of demand for metal coatings.

The scale of the chemical tin can industry has steadily increased. The sales revenue of the chemical tank industry has increased from USD 11.6 billion in 2017 to USD 19.6 billion in 2020, an increase of 9.82%. It is estimated that the revenue of the US chemical tank industry in 2021 will be approximately 10.9 billion yuan. With economic growth, the chemical tank market has great growth potential. The chemical tank market is expected to grow by 6.4% in the next three years, and the chemical tank market is expected to exceed US$14 billion in 2021.

The coating market has a vast space. The downstream of the chemical metal packaging industry is mainly the metal coating industry. Coatings are widely used in the food metal box, chemical metal box, and beverage can industries. In 2019, the global output was 71.44 million tons, with an output value of about 192.9 billion U.S. dollars. The U.S. output was 20.36 million tons with an output value of about 640. Billion U.S. dollars, the US coating market is expected to reach 25 million tons in 2021. As the pandemic slows, the operating rate is expected to increase, supporting downstream demand for metal coatings. From January to December 2020, the country is affected by the pandemic, which is down 8.5% year-on-year and 0.1 pct from the previous 11 months, but it is still at a low level.

2). Beer cans become the main growth point of the future metal food can industry

The United States is the world's largest canned food producer, and per capita consumption has much room for improvement. The output of canned food in 2016-2019 has shown an overall upward trend, and the output of canned food in 2018 was 10.279 million tons. The per capita consumption of canned food is much higher than that of other countries in the world. The annual per capita consumption of canned food in Western Europe is 2 kg and 6 kg, respectively, and the annual per capita consumption of canned food in the United States is about 6 kg. With the consumption upgrade trend, canned food is more convenient and faster. In the future, as the frequency of consumer travel and business trips increases, the canned food market has a broad space.

The scale of functional drinks is growing rapidly, and beer cans will become the main growth point of the industry in the future. With the economic recovery, the retail volume of functional beverages has risen rapidly, from 8.26 billion liters in 2018 to 11.78 billion liters in 2019, an increase of 12.56%. It is estimated that the retail volume of functional beverages in the United States in 2021 is expected to reach 15.037 billion liters, which will promote the increase in demand for beverage metal can packaging. Two-piece beer cans account for about 57%. The current share of American beer cans is about 25%, and the share of European and Japanese cans exceeds 12% and 8%, respectively. Metal packaging has better sealing performance than glass packaging, and its light weight is easy to transport and carry. At the same time, a large number of glass factories were shut down due to the impact of supply and environmental protection policies, which significantly increased the production cost of glass bottles. The future growth of metal cans has become a development trend and will become the main growth point that will drive food metal packaging in the future.

3 )Growth trend of functional beverage metal cans

The scale of the food and beverage metal can industry has steadily increased. The output of US food and beverage metal cans has increased from 56.4 billion cans in 2015 to 111 billion cans in 2019, with a CAGR of 11.95%. It is estimated that the US food and beverage can production will be 131.9 billion cans in 2021. The food and beverage metal can industry is mainly subdivided into two Piece cans, three-piece cans and miscellaneous cans, two-piece cans and three-piece cans account for a relatively high proportion. In 2019, the output of two-piece cans and three-piece cans was 51 billion cans and 42.8 billion cans, accounting for 45.95% and 38.56% respectively. . In the future, with the upgrading of beer cans and the continuous expansion of the canned food market, the food and beverage metal packaging market has broad room for improvement.

2, the development trend of metal packaging companies

Large-scale metal box container packaging companies purchase raw materials on a large scale, and the cost side has scale advantages. Large-scale metal packaging companies have formed long-term good cooperative relations with their suppliers, obtained relatively preferential procurement prices, and have procurement advantages. For example, some large metal packaging industry companies have signed strategic cooperation agreements with Gangcai Group suppliers to obtain preferential purchase prices. Therefore, large enterprises have scale advantages in raw material procurement.

The reduction in steel production capacity has led to price increases and reduced the gross profit margin of the metal packaging industry. Since 2020, the average price of cold-rolled siding has increased from US$550.46/ton in 2019 to US$680.82/ton in 2020. The cost of raw materials accounts for up to 70% of the cost of metal packaging. Affected by the sharp increase in raw material prices, the gross profit margin of the metal packaging industry has declined

3) The Internet of Things is improving globally, and the metal packaging industry is expected to develop towards digitalization and networking in the future

With the intensified competition in the metal packaging market, companies are paying more attention to brand effects and precision marketing. Can body QR code data marketing has become a new promotion method. The method of printing the QR code on the can body will help companies to accurately mine low, medium and heavy users, provide powerful data support for online marketing, channel management and terminal control, and provide data reference for building brand effects and optimizing market decisions.

4. Metal packaging has a wide range of applications and great development potential

Metal boxes are widely used in industrial product packaging, transportation packaging and sales packaging. Metal packaging materials are now used more in the food field. For example, food cans and beverage cans using tin-plated iron substrates have been widely used. Metal box packaging Convenient storage and transportation; due to the good sealing, barrier properties, and good pressure resistance of metal packaging products, it will be safer during storage and transportation, and transportation risks are lower. In order to reduce the loss rate of commodities during transportation and increase corporate profits, food companies generally adopt metal box packaging.

Latest comments